For many with solar or DIY and maybe older solar installations the key to making money may not be Feed in Tariff, which is now known as SEG. Seg payments vary from provider to provider but tends to hang around the 4p per Kwh

The key here is to remember that saving the power or some export tariffs are far better value.

For most homes, you will have a 48v system if you have a hybrid inverter, if your grid tied then carry on reading. and skip the battery section.

Have a battery its better!

If you have a variable tariff you can be paid up to 40P a kWh you would need to store the power in a battery and then sell power (timed export) to maximize the returns. you could even charge at cheap rate (0.07pkwh) and then sell at the high rate. you would need to have a monitoring system and control of the inverter, some are better than the other.

Looking at our 15kwh battery you can get up to £6.00 per day but halve this return to be on the safe side. the cost excluding the inverter is around £2200 so at best you would take 1 year and 1 day to return to zero so the following year you will start to make money. the cost of energy is rising and not falling, and you can cycle 6000+ times so your going to profit for about 14 years. thats about £24,637.50 in its life time – I did that math based on 15kwh per day at £0.30 kwh

Crypto mining

Crypto mining is not a get rich and I’m sure we have heard the stories, what is missing from this story is the defacto decreasing returns. there is a thing called “the halving” where the value of the coin is halved.

When that seems to not make sense, the machines used to make the coin ( or what ever it is) become more powerful. so they would make more and more if things stay the same… that makes perfect sense.

They have this other thing called difficulty, this seems to rise up making the mining take longer and require more powerful machines.

Mining cost.

One of the big things with mining which is self serving is the miners, I mean the machines to mine, they are costly and £5000 – 15,000 is a big investment but then the returns are not bad about £500 pcm.

the next cost is the power to run the miner, this is dropping a little but mostly they are around 3500w.

Most inverters (g89) are 3600w…. so you can see if you have full power you could run one miner.

but to give you some idea a miner also costs 84kwh a day to run, which in the uk that would amount to £665 per month. so you are working here at a loss of over £165 per month.

Mining for SEG

Clearly we don’t want to lose money mining but you want to make money, if you dont get SEG then Crypto may be the answer. if you have a known excess then using this to power a miner that is lower power is very much worth it.

The profit is not really a consideration here as what we are looking at is value per kw. we know that we could be SEG paid £0.04 kWh so anything above this value is a win.

The trick here is the mining reward ( payment) in respect of the power used to obtain the reward, clearly this must be within the excess of the power produced. This will come down to the coin type and the miner type.

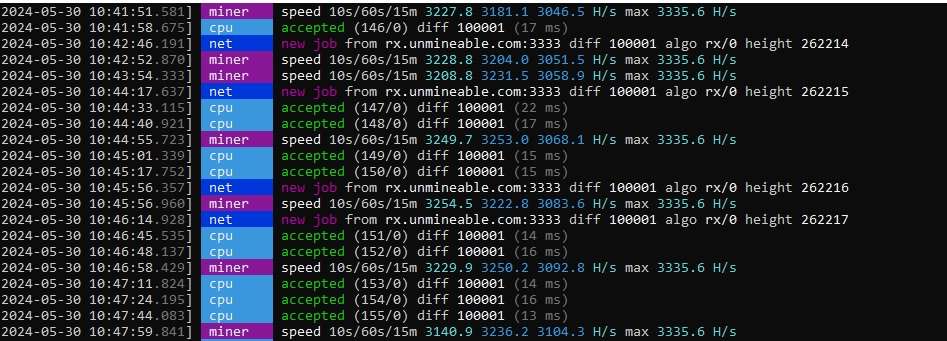

Miners make fractions of the coin, and the miner performance ( hash rate) differs depending on the coin type and difficulty which in turn effects the reward.

Here is an example – miner power consumption 456watts

Single part earns 0.000000673914LTC consuming 0.0008563288 kWh

Cost of grid power £0.003293

Earns £0.000044 (in 1.29 seconds)

Difference being £0.0032495

| Using the above you would make: in 1 minute £0.00204651 in 1 hour £0.122790 |

If we change the value of the miner to 500w and we make £0.12 in the hour, the value of the mining is £0.24Kwh – (500W (1/2kwh) 12 x2).

A bonus and wolf

Coins value go up and down, typically they hover but some times they double and sometimes half…

So you may NOT get your money back, or you may break even or make a little or you may double the money. if we look at bit coin we can see its doubled in value, ltc in red we can see the value here has dropped, this is the year we have had a halving ( may 2024) and over the past 6 months the LTC value is up 18.76% if it goes up or down in trending will make a difference to the workability of crypto mining.

If you look at LTI then the best value appears to be over a longer period (3-5 years) some are around 5 months, so it is hard to say that holding on to the crypto will make money or lose money, but at the time, in the days and weeks around the transfer you could be making some money with a lower risk of holding out to see if the coin value doubles or becomes worthless.

Powering it all.

When it comes to power your value will differ between the type of mining you can do, for example smaller miners – lower power can add up to make it worth while. After all the excess power is “free energy” which would be making the companies more money.

Timer or smart switches would be the way to go with solar. the problem that solar has is the ups and down of the power provided by the sun.

The second thing I have noticed is the value of the coin can make a difference to the returns.

I can say that if you are paying £0.26Kwh from the grid then you are losing money even if you are getting £0.24Kwh from mining, okay that’s 2 pence per hour. and it may also appear good if you are paying £0.07kwh for night charging from the grid and using the power to mine making you just £0.05kwh.

I have to say there is no clear profits, where the return of the coin in normal money would seem a great option, knowing that you are making 10P or 20P for your excess kWh would be great, but that’s not always the case. I have a system using 180watts and its made 1 penny in about 8 hours. This means I am i am not making money and if I paid for the power then it would be 144% Not Worth it.

No responses yet